As I look around post-holiday season, I am seeing more and more regular, non-technical friends and family get connected on their mobile devices. What does that mean? A great example is that of my father-in-law who got rid of his old Motorola Startac and exchanged it for an iPhone. Yes, he got an iPhone, and then days later I got a message to get connected to him on Facebook. Ever since, he has been using the phone to take pictures nonstop, send emails and SMS messages, stay connected to Facebook, and surf the web looking for the latest news or directions. I last wrote about the iPhone in November 2007 when my wife and her friends started getting iPhones. Clearly that was just the beginning of a longer term trend for mobile devices to get more powerful, easier to use, and more widely deployed into the market. Since then, we have the new Google phone, a better Palm device, Blackberrys for consumers, and numerous other devices from Samsung and HTC.

So is this the year that mobile computing becomes mainstream and that mobile software/service companies become a household name? More importantly, will there be any grand slam venture capital opportunities in wireless? Through various forms I have been involved from an investment perspective in wireless-related companies since 1996 when I made an investment in a company called AirMedia. It was way ahead of its time in the sense that it had a hardware device that connected to a paging network to deliver email alerts, stock quotes, and breaking news. From a business model perspective we had it nailed…or so we thought…buy the hardware device at cost and we would make money back by selling a monthly subscription service. It raised an additional $30mm of venture capital after we invested and subsequently was long on buzz but short on customer adoption. I learned a lot from that investment. The first lesson I learned is that "pioneers get arrows in their backs." In other words, we were way ahead of the market and were bleeding edge. Wireless was thought of as the next big thing, but we were way too early and also had to get people to adopt a new device-virtually impossible! Secondly, I learned that you can't invest in a technology in search of a problem to solve. It was surely cool stuff but no one really cared and in order to get people to care you had to spend lots of money to define not only a new product but also a new category – the wireless Internet connected device.

Here we are 13 years later and I have seen very few successful wireless pure play software/service related companies. I wonder if 2009 is the year that some wireless startups breakthrough. Trust me, I am a big believer in being connected anywhere and anytime but at the same time I am skeptical of how these startups plan to make money. What is different in 2009 versus 1996 is that we do have a user base, we have some awesome devices that are cheap, powerful, and easy to use, and we have all you can eat service plans with unlimited data. However the same fundamental challenges still remain as it is still difficult for wireless startups to get their products to the market. You can either go on-deck through the carrier channel and their walled gardens or off-deck through the web where you will need to have an incredibly viral product or spend lots of money on marketing. You can also reach users through handset manufacturers like the iPhone marketplace or through Nokia (one of my portfolio companies Gizmo5 is also distributed through Nokia) but in these cases you are either still under one company's complete contrl (Apple) or have to spend incredible amounts of time negotiating with a large company like Nokia.

So even with a huge user base of wireless devices and users, the odds are still stacked against pure-play wireless startups. If anything, I see wireless as just a natural extension of any web-based product or service. Take Cisco's Webex as an example. Even though their users have wanted a mobile app for awhile, they just launched an iPhone app that let's users schedule and join Webex conferences from their device. Why do we need a pure-play wireless conferencing play if the big guys can easily extend their functionality? So while we read about increased wireless usage it is clear to me that either many folks are still using the lowest common denominator on their devices (taking pictures, sending SMS messages, doing a simple web search) or mostly using the large incumbents' technology like Google Maps or GMail or Yahoo on the Go or Microsoft Search or Facebook. This is a tough market for startups to break into and while we may see some products get strong adoption out of the gate like a flatulance app on the iPhone, this doesn't mean that these are real businesses.The bottom line is that as more apps become delivered over the cloud, the delineation between a desktop play and wireless one diminishes rapidly unless you are a mobile only location-based service. Wireless is just a technology and 2009 will be a year where wireless and desktop continue to blur as people only care about what web service they use and always expect to get it from any device over any network.

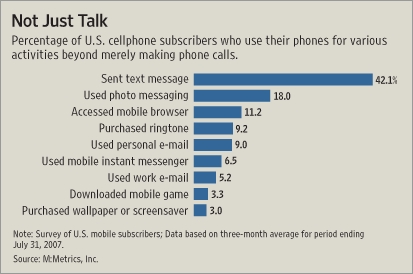

It represents the reality and the opportunity for wireless applications – the majority of people today only send SMS messages and a relative minority use their phones for mobile browsing, email, and other applications. Will easier to use phones, faster networks, and better applications change that? I am sure that it will as users like my wife and her friends who are not the most technically savvy are starting to get iPhones and using it to post pictures to websites and view Youtube videos on the run. However, in the meantime, I would also remember that the lowest common denominator is still SMS so don’t forget that user base when building mobile apps like community based functions, social networking, games, advertising, etc. because that crowd is still dominating the here and now.

It represents the reality and the opportunity for wireless applications – the majority of people today only send SMS messages and a relative minority use their phones for mobile browsing, email, and other applications. Will easier to use phones, faster networks, and better applications change that? I am sure that it will as users like my wife and her friends who are not the most technically savvy are starting to get iPhones and using it to post pictures to websites and view Youtube videos on the run. However, in the meantime, I would also remember that the lowest common denominator is still SMS so don’t forget that user base when building mobile apps like community based functions, social networking, games, advertising, etc. because that crowd is still dominating the here and now.