As we look into 2014, we thought it was important to reflect on our activities in 2013 and refocus and refine our thinking and messaging as a firm. We are thematic in our approach and primarily known as seed investors with a focus on enterprise and companies that can scale quickly. To date our messaging has been clear, but we also could not ignore the fact that companies like Plain Vanilla Games took off quickly and became known as the fastest growing mobile game in history. The challenge for us is how to explain this in a focused, simple manner.

Here is our attempt and then I will break down how it all ties together:

boldstart’s messaging

We have over 20 years of experience backing bold founders with big visions. Our founding team has led first rounds in market leading enterprises such as LivePerson (LPSN), GoToMeeting (sold to Citrix), Greenplum (sold to EMC), and 24/7 Media (TFSM). BOLDstart helps founders at the seed stage accelerate their growth from idea/ alpha phase to product market fit and successful Series A round. With a focus on seed investing in the mobile, agile, and smart enterprise and business models that harness the power of network effects, our entrepreneurs have successfully been able to raise over $200 million of financing following our initial seed investment. Founded in 2010, we have backed 27 awesome teams including Indiegogo, divide.com (sold to google), goinstant (sold to salesforce), blaze.io (sold to Akamai), thinknear (sold to telenav), Plain Vanilla Games (quizup), rapportive (sold to LinkedIn), and klipfolio.

ok, so let’s break down the key elements of our message:

“We have over 20 years of experience backing bold founders with big visions.”

That is pretty self explanatory. However, to add to this, we love entrepreneurs who have big visions but of course, start with an incredibly focused product. This means we invest in product-driven engineering teams where all of the development is done in house and where rapid iteration is a key to success.

“helps founders at the seed stage accelerate their growth from idea/ alpha phase to product market fit and successful Series A round”

While this sounds simple, there is a ton of work that goes into helping our portfolio companies get to a successful Series A. This includes thinking through what milestones the startups will need to hit to make them attractive for an A round and ensuring there is real plan with enough cash (typically 18 mos) and runway to get there. Since most of our companies have a product that is in alpha stage (super early, buggy), we like to help our entrepreneurs get more market data and customer feedback through our relationships to help them further refine their product.

We also help our teams find key engineers, and sales and marketing folks who can help build and refine the gotomarket strategy for the entrepreneur. Finally, we try to prewire the Series A investment by getting our portfolio companies to meet with the right partners at the right firms early on before they even need money. Getting feedback from smart Series A funds helps the entrepreneur further hone their message.

“focus on the mobile, agile, and smart enterprise”

The big trend in technology today is the growth of mobile. The other force we always hear about is the consumerization of technology meaning that much of the innovation in design, applications, and user interface is driven by consumers first (think Facebook, twitter) and then brought into the enterprise or business after the fact. Yammer would be a great example of a Facebook like feed being brought into the enterprise and then being sold to Microsoft for $1.2 billion. Here at BOLDstart, we believe we are still at the very beginnings of this consumerization trend in the enterprise and hence our focus on the “mobile and agile enterprise.” Many of our portfolio companies in BOLDstart II reflect this theme such as Truly Wireless and handshake .

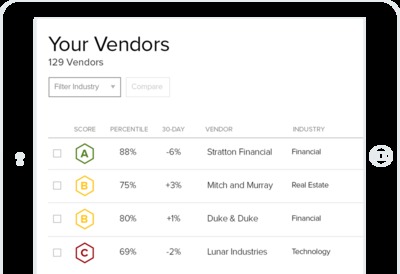

The other big theme is one of big data. As you know, we believe big data is passé and the real trend is smart data or what you do with the big data that matters. Storing and scaling tons of data cheaply and efficiently is already done. Smart enterprises are analyzing all of this data to make better decisions, increase revenue, and improve operating performance. Making sense of that data with algorithms and other software is the next wave and is reflected in investments like Coherent Path, klipfolio, security scorecard, and preact .

“companies that harness the power of network effects”

we are really investing in companies that can scale rapidly with zero to limited to market costs. Another way we think about this is that we fund products or companies that derive most of its growth by users recruiting other users. In industry terms, this means we looks for companies that have a high viral coefficient. Since we can’t predict the future, our investments in these types of companies are driven by small data sets that we can extrapolate to determine the potential opportunity and usage. For example, when we funded Plain Vanilla Games (Quizup), the team had launched a small test app in Europe called Eurovision Quizup where they were able to sign up 10,000 users in a week and one month later still had 30% of the users come back up to twice a day for 30 minutes a day. Given that other analogs like Words With Friends (scrabble) and Draw Something (dictionary) were quite successful and that no one had done Trivial Pursuit in the right manner, we decided to back the company in the seed round. As they say, the rest is history. We have taken this same approach with other networked investments like memoir.

finally, this theme is also applicable for b2b…

There is also a b2b theme as companies like ooomf and emissary.io are leveraging network effects, viral marketing, and growth hacking to ramp up their user base in the enterprise side. In addition, many enterprise software companies are exposing their functionality/service via APIs so other developers can easily build upon their platforms. APIs are the new business development models for these companies and once again represent many of the elements of consumer platforms. Companies like yhat, zillabyte, and goinstant fit this model.

In the end, we believe that we are better investors in the agile and mobile enterprise because of our front row seat investing in innovative, networked consumer companies. Companies like Plain Vanilla Games and Memoir help inform our thinking on what may/may not work from an enterprise perspective. The long term trend in the enterprise that we have been investing in for years is bottom up marketing. Instead of selling at the C-level, companies are better off getting one user in a department to use a product and then building in viral hooks and loops to help bring other employees on board. This is yet another example of the consumerization of tech. One of our most recent investments which is in stealth mode (will be announced shortly) is a great example of this – 3 users began to use the enterprise product and within 2 weeks, 42 of 45 employees were using the service and were interacting with it at least twice a week over a period of a couple of months. Now there is a backlog of over 200 companies waiting to use the system (we will give more detail in the next newsletter).

We hope this gives you a better idea of how we are thinking about opportunities and building our portfolio in 2014 and more importantly how to approach and what types of companies and teams in which we like to invest.