As I prepare for my trip to Israel this weekend for a board meeting, one piece of equipment I am sure to bring is my Plantronics DSP 400 headset so I can Skype with the CEOs in my portfolio companies. I have been using Skype for the last 6 months and can honestly say that it not only saves a ton of money but more importantly allows me to end the phone-tag game with my porfolio company CEOs and easily communicate with them. Sure VOIP is great from a cost-saving perspective, but having presence is even more important in my mind. I know when someone is available to speak and when they are not-no more wasted time with voicemails or I’ll call you back later. As you know, as an active board member and investor much of the value add happens outside of the board meetings in ad-hoc in-person meetings and calls. Prior to Skype I had all of the CEOs that I worked with logged into IM, and we would frequently have long, off-the-cuff exchanges throughout the week. Well, with Skype, we can not only IM but through an extra click turn that into a high, value-add phone call. Just like in customer service, not every exchange needs to escalate to a live phone call, but having the ability to easily point and click to make it happen is a huge benefit. Wait till Skype adds live video to its platform and the value of that conversation goes up higher. Of course, the beauty of Skype is that as long as my laptop in logged into a network, I can easily make calls from anywhere in the world. Since it is the holiday season and a time of giving, one of the gifts that I sent to a new CEO hire (will be announced in New Year) was the the Plantronics DSP headset. I am now just waiting for him to get registered so we can start Skyping.

Month: December 2004

It takes time to build value

During the boom, many VCs funded companies and created great exits within 12-24 months of funding. Before that time, the standard rule of thumb was that it took about 5-6 years for a company to reach maturity, profitability, and potentially become an IPO candidate. We did our own analysis of venture-backed software IPOs a couple of years ago (based on SEC filings, etc.) using pre-bubble data and this is what we found. Companies pre-1998 that went public received on average about $20mm of venture funding, were 6 years old, were EBITDA postive, and had a pre-IPO value of around $170mm (includes companies such as Peoplesoft, Intuit, Mercury, Documentum, Checkpoint, and Veritas). An interesting side note is that Veritas and Peoplesoft both went public in 1993 and were both acquired last week. This reminds me of a conversation I had this summer with a Veritas executive who said how difficult it was to scale beyond $1-2 billion in revenue and that size matters. There were a number of companies in that revenue band but very few above it like Microsoft, SAP, and Oracle. Getting back to the data on software IPOs, during 1998-1999, the companies that went public received around $30.0mm of VC funding, were 5 years old, were not EBITDA positive, and had an average IPO value around $375mm (includes comps like ISS, Micromuse, Art, Interwoven, Vignette, Informatica). The rule of thumb these days is that companies need to have around $50-60mm of revenue and be profitable for 1-2 quarters before going public. That is certainly a high bar and many companies will not get there.

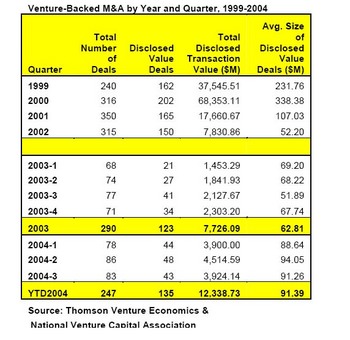

Another way of looking at company maturity is to look at M&A data. This week’s Plugged In column from Barrons has some great data on M&A in 2004 and how many of the companies that went public or were acquired were the very ones left for dead over the past few years. Of the 247 venture-backed companies which were acquired this year, 222 or 89.9% received its first venture funding prior to 2000 and 159 or 64.4% received its first round of funding between 1999 and 2000. Anyway, as I look at the data from Thomson Venture Economics and the NVCA, it is further proof that we are returning to normalcy in terms of the time it takes to build value.

As you can see from the chart at the left, average valuations of M&A deals while trending upwards in 2004 to $91mm, is still way below the $231mm and $338mm numbers in 1999 and 2000. As we return to a state of normalcy, the point is that it takes time to build value and nothing happens overnight. In addition, I also see the definition of what makes a great exit changing. If we are returning to a pre-boom normalized valuation level where you need to make good money at exits of $50-100mm and a home run deal is around $250mm, it behooves us to make sure that we invest in capital-efficient business models to generate the same 8-10x that we once could with an average deal size of $300-400mm (see an earlier post for more on this topic).

As you can see from the chart at the left, average valuations of M&A deals while trending upwards in 2004 to $91mm, is still way below the $231mm and $338mm numbers in 1999 and 2000. As we return to a state of normalcy, the point is that it takes time to build value and nothing happens overnight. In addition, I also see the definition of what makes a great exit changing. If we are returning to a pre-boom normalized valuation level where you need to make good money at exits of $50-100mm and a home run deal is around $250mm, it behooves us to make sure that we invest in capital-efficient business models to generate the same 8-10x that we once could with an average deal size of $300-400mm (see an earlier post for more on this topic).

Best VC Blogs

A number of my readers alerted me to the fact that Fast Company has a survey on the best VC blogs. Considering that VCs can be quite competitive and my cohorts Brad and Jeff are already stuffing the ballot box, please take a moment and cast your vote for me. All kidding aside, since this is not a zero-sum game and if you haven’t already, I suggest getting to know some of the other VC blogs that I enjoy reading. These include Jeff Nolan, Fred Wilson, Brad Feld, Steve Hall, Steve Brotman, and Ventureblog. I enjoy participating in the conversation with these guys and I expect to see many more VCs join the ranks helping make our industry more transparent and less mysterious. Educating entrepreneurs, sharing ideas, learning about the next hot technologies, and meeting other plugged-in people make this an enjoyable and rewarding pastime. Thanks for the support and keep voting.

Consumer growth and globalization

I was catching up on my Barron’s this week and a quote from Ajay Kapur of Citigroup caught my attention. When discussing his macro investment themes Ajay said, "The world is driven by Asian exporters and U.S. consumers. In the future, it will be Asian consumers and U.S. exporters." Given that perspective, it is no surprise that VCs have been pouring dollars into consumer technology plays over the last 18 months in addition to investing in China and India to tap into their consumer bases in the future. Many VCs seem to be down on the enterprise space. Corporations are hoarding cash and are risk averse in terms of spending on new technology. That being said, there are some major trends occurring like the move to a service-oriented architecture and automation and virtualization of the data center. Given the amount of time VCs are spending on global and consumer investments, I believe it is the right time to continue investing in enterprise start-ups developing product 12-24 months ahead. As for the consumer globalization trend, I have been quite happy with my investment in the the Vanguard Emerging Markets Stock Index fund (VEIEX) which has been up 19.75% YTD.

Some thoughts on building your team

I was recently advising a friend of mine who wanted to expand his team and hire some senior executives, and it occured to me that others could benefit from some of my thoughts on recruiting. As you know, hiring is a critical component in the success of any company. People and their ability to execute are what separates the winners from the losers in any industry. Hiring the wrong person, particularly in an early stage company, can cost you dearly. On the contrary, hiring the right person can make a huge positive impact creating significant leverage through what I call the A-Player domino effect. So here are some of my random thoughts on hiring new executives. I tried to make this as logical and short as possible – some of the thoughts below can clearly be expanded into longer posts.

1. Build a target profile: Put together a specification of the role, responsibilities, required experience, and intangible qualities you are looking for in a senior hire. Share the specs with your board for additional feedback to make sure everyone is on the same page with respect to the person needed and the major goals and objectives. Many times, the specification itself can highlight bigger issues about company direction if everyone is not communicating and on the same page. Does a board member want to change the goals for next year? Is everyone aligned with that change? Understanding who to hire and what their goals are incredibly important – hiring a person without having a spec will result in failure nine out of ten times.

2. With the specification in hand, put together a target list of potential companies where you can find this executive. The ideal companies are in the bullseye and others will be in concentric circles one or two removed from the center. For example, if you have a network security startup, the obvious players will be other security companies that sell similar products at similar price points with a similar distribution channel. One concentric circle out from the bullseye could include networking companies that have a similar business model and distribution channel. From an experience perspective, the perfect candidate will be someone who has had a VP role (if you are looking for a VP) and worked at other large brand name companies as well as been successful at earlier stage entities. Like in darts, it is not easy to get a bullseye (unless you spend too much time in the local pub), so you need to think of all of the tradeoffs that must be made in terms of the characteristics of a new hire which will include qualities like leadership, requisite experience, and domain knowledge. In general and depending on the role, I tend to prefer leadership and experience over domain knowledge and hungry, up and comers over rich and happy.

3. Begin the search – look in your own network – trusted people you or your board have worked with before always come first as long as they meet the spec. Putting a spec together eliminates the need to do favors and hire friends. If you can’t find someone in your network, bringing in a knowledgeable executive recruiter can help. The right firm will always help you find the person not necessarily looking for an opportunity – many times that is the person you want for your company. When picking a search firm, I prefer boutiques or small, highly focused shops which tend to have the partners doing the work and making the initial calls to prospects. Your executive recruiter is an extension of your company and must be able to give a great pitch to high level prospects. A recruiter who gets it and can properly sell the story to prospective hires will truly help the company.

5. Make hiring a priority – You have to stay on top of the search. If you are using a recruiter, I suggest having weekly status calls in the calendar with members of the search team, typically one or two from the company and one or two board members. Regardless, if you want to bring high caliber talent in quickly, you have to make hiring a priority. The more time you put into it, the more you will get out of it. Whatever you do, do not slowroll the process and leave people hanging. Change a few meetings, etc. if need be, to get in front of the right person sooner rather than later.

6. Reviewing resumes – Resumes are not everything but what I look for is a person’s story. Do they have a history of demonstrated success? Have they worked at other blue-chip startups or well known companies and been a top player? Were they responsible for delivering meaningful results and contributing to the success of the company? These are just some of the things that cross my mind when reviewing resumes. A history of working at companies that repeatedly failed will certainly worry me.

6. Interviews – It is always good to have a proper blend of selling and interviewing in your first meeting. Many times you will know by a person’s resume whether they have some of the experience needed to do the job. Obviously you will want to dig into specific examples of how the prospect overcame challenges, drove new initiatives, led and hired a team, etc., but always leave some time to do some selling on the opportunity. Assuming you like the prospect, you should get another set of eyes like some of your VCs to meet with the candidate and interview him. As you meet a number of prospects, chemistry becomes an important determining factor in hiring. The superstar on paper may not always be the best fit for the team if the chemistry is not there. I always like to use the Detroit Piston/LA Laker analogy. Both teams had consummate professionals playing at the highest level of basketball but the team with all of the superstars did not come out on top – there was no chemistry. As you move a candidate further in the process, doing backchannel references are the most important ones you can do. That means you need to call some of the other VCs and execs at prior companies who are not on the candidate’s reference list. You can learn alot about a person from these checks. I have passed on a number of candidates based on some negative backchannel references.

7. Close them – now you have the right person, get the deal closed as quickly as possible because as I have said before the longer it takes to close a deal, the more chances it has to fail.

NYC 2.0 (continued…)

In the past, I have written about a number of first generation NYC entrepreneurs coming out of the woodwork to launch new ideas. Sure, the market may not be great right now but in my opinion it is the best time to build a business. As an entrepreneur you have time to develop your product, refine and test it, and get it ready for when the market turns. The most recent addition to this list of second generation entrepreneurs is Andrew Erlichson, former CEO and cofounder of Flashbase.

When I first met Andrew in late 1998, he had just finished his Stanford Ph.d program in EE from Stanford with other well-known classmates. My fund seed invested in his idea which was to allow anyone to build database-enabled, web-based applications through a simple GUI. Some of the applications that users built ranged from simple forms for their website to richer ones like help desk, call center, project management, and sweepstakes apps. This was 1998 and Flashbase was a true predecessor to Intuit’s Quickbase. We were obviously way too early but after a year of blazing this trail, we ended up selling the company to Doubleclick for a nice return. After spending a few years with his golden handcuffs on at Doubleclick, Andrew is back in action with his next project, Phanfare.

Like any great consumer service, the company started because Andrew wanted to solve his own problem with sharing his digital photos. For many, the first instinct with a digital camera is to make prints. However, it is clear that this will evolve and people will share more and more of their pictures online. The problem is that the print sites only want you to share with friends as a vehicle to sell more prints. They do not keep your photos up indefinitely, their branding is all over your private albums, and your friends and family get bombarded with email to buy more prints. So Andrew did what most entrepreneurs do, created his own software and service. Simply put, Phanfare allows users to share and back up their digital photos in a simple, permanent, polished, and unbranded way. You can even use your own URL to share photos.

From a technology perspective, we are seeing an evolution in the way network client software is written. Initially, the client sw was web-based, with simple html as the implementation technology. Then interactive sites moved to using client side scripting like javascript. Now, for media intensive applications, we are starting to see full fat client network applications like iTunes. While I am a fan of software as a service, it truly makes sense for apps manipulating or using large files to be client-side but network-enabled. With Phanfare’s client software, you can manipulate your pictures locally from within the app while your website stays in synch in the background. While the idea of sharing photos does not sound like a heavy-duty technology initiative, Phanfare’s founders were trained to build cache coherent multiprocessors at Stanford. This means that like any web-based service you can use Phanfare from any computer with a simple download and keep your albums synched.

So as the holiday season approaches and you snap tons of photos of your friends and family, I suggest giving Phanfare a try. I have my own family website and may just transition it all to Phanfare. While the service is great, my only question is how big this market will be for Andrew. That being said, it is great to see Andrew back with a new venture.